At present some exchanges offers you margin trading with perpetual futures/swap contracts..

The main advantage of this kind of trading is that you don't need to keep deposits on both coins to buy and sell, you will need to convert your deposit to USDT (usually) and use it as margin .

In the latest 8.4 version of VIP Crypto Arbitrgae Software you can find 4 exchange connectors allowing trading with perpetual futures/swaps: BINANCE_USDT_FUTURES, BYBIT_USDT_PERPERTUAL, HUOBI_SWAP, OKEX_SWAP. Please study each exchange requirements

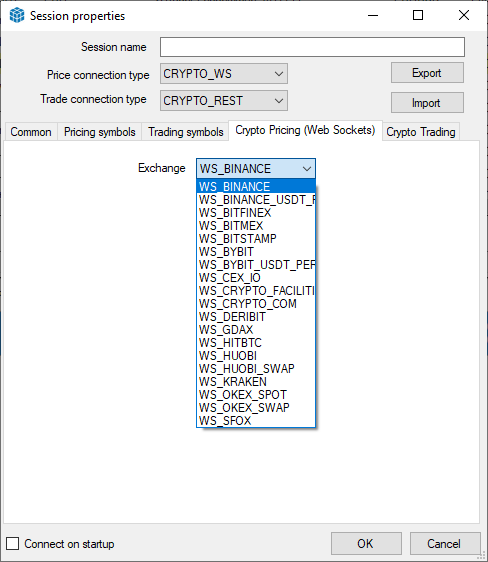

Crypto Arbitrage Software Pricing Connectors

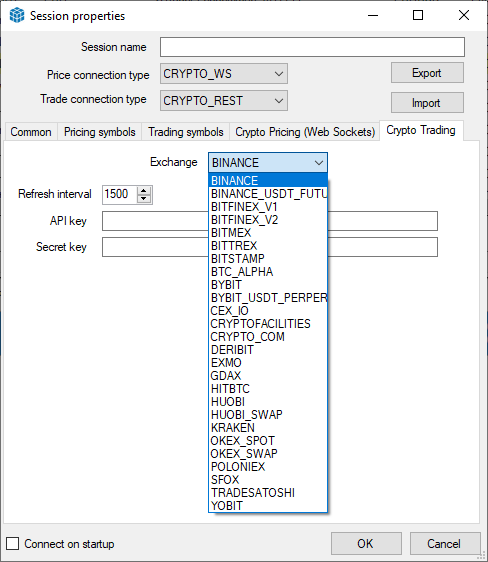

Crypto Arbitrage Software Trading Connectors

Good explanation on perpetual contracts.

What is a futures contract?

A futures contract is a kind of contract to either buy or sell an instrument for a certain price at a certain time in the future, think of it as agreeing to close a deal in the future,

If you have some experience in the market, you know that trades take a very short time to complete. In a futures market, this is not the case. The reason it is called a futures contract is that it is an agreement for the future, which allows the parties to trade in the future on a specific date. This market does not let you buy or sell the instrument, but it allows you to create an agreement to trade later on, as the contract is brought to fruition. As you may have already figured out, future prices may change as more time goes on, creating risks for the buyer and the seller, and the more time is spent before executing the contract, the higher the risk that both parties experience

Why users trade futures contracts?

Risk management and hedging are the reasons that people choose to trade these futures contracts. Even if a trader does not own an instrument, they can try their luck on it. The futures contract also provides traders with leverage, they can partake in trades larger than their account balance.

What is a perpetual futures contract?

This is a different type of futures contract, one that will never expire. A trader can hold their position indefinitely, but the trading of these contracts is all according to an Index Price, this price is given by the average price of an asset. Therefore, unlike a regular futures contract, the perpetual futures contracts are most likely going to be traded at a price identical to market price. The largest difference between these and a regular futures contract is the indefinite execution date.

What is the initial margin?

This is the smallest cost you need to pay in order to open a position with leverage, it backs up your position and acts as a security measure.

What is the maintenance margin?

This margin is the minimum amount of the security or collateral that you must be of ownership to in order to keep all of your positions open. If this is not met, your positions will either be liquidated or you will be asked to add more funds. If you are trading cryptocurrency, you will most likely be liquidated.

This system is different throughout various exchanges and markets, but usually, if the account has remaining funds after liquidation is executed, they will be given back to the user, but if there is less, the user is labeled as bankrupt. You are charged extra fees when you are liquidated, so closing your positions before you are liquidated, or adding more funds will eliminate that possibility.

What is the funding rate?

When a funding rate is positive, traders that have a long position open, pay the ones that have the short position open. The rate of these payments is calculated according to the interest rate and premium. When a perpetual futures contract is trading higher than the spot markets, long positions will have to pay short positions due to the positive rate.

What is the mark price?

This is an estimate of the actual value of the contract, or what the fair price is. This is compared to the price that it last traded at. If this price states that the price is unfair, some liquidations may happen depending on the volatility of the market.

What is PnL?

PnL stands for profit and loss, this could be realized or unrealized depending if the order is still open or closed. As you have probably already figured out, an unrealized PnL occurs before the order is closed, similarly to the realized, which occurs after and cannot change anymore. This is unrelated to the mark price, it is only related to the actual price that the order was completed at. Whilst this cannot change anymore, an unrealized PnL can keep changing until you close your position.

What is Auto-deleveraging?

This is the last step that occurs when the insurance fund mentioned earlier is unable to cover all of the traders’ bankrupt positions. This is a very unlikely situation, but this technique may require highly profitable traders to allocate their funds to those bankrupt.