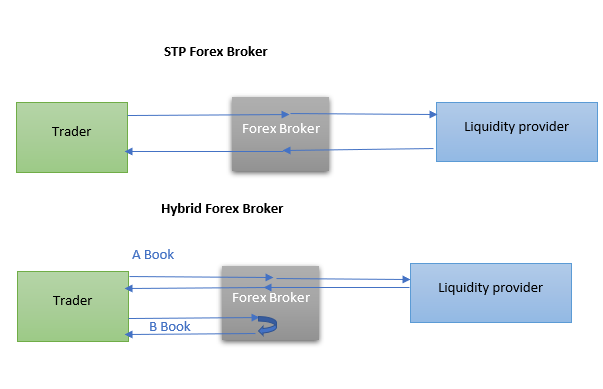

Brokers can be divided into three categories. The first category is made up of straight-through-processing (STP) brokers. STP brokers send clients’ orders to the external market, where they are filled by liquidity providers. In an or an setting, this kind of broker is virtually nonexistent, so we don’t need to dwell on this category.

A second category of brokers is the hybrid broker. As the name suggests, hybrid brokers use a combination of two business models: the STP/A-book model and the B-book model. Clients who make money are placed in the A-book (where orders are filled externally), while clients who lose money are kept in the B-book (where orders are filled internally by the broker). Keeping unprofitable traders in the B-book ensures that the broker derives revenue not only from commission fees, but also from deposits lost by traders in the B-book.

The third category is the B-book broker. B-book brokers do not use the interbank market at all. Although they may occasionally take advantage of copiers to hedge risks, they tend to introduce significant order execution delays and slippage to prevent traders from making money and the broker from losing it. B-book brokers trade against their clients. For a B-book broker, therefore, a trader with a successful strategy such as arbitrage or trading the news is a highly problematic kind of trader. If the trader makes money, the B-book broker incurs a loss. To protect itself, the broker resorts to using delays and slippage, which makes well-performing strategies all but ineffective.

It is the hybrid broker that interests us the most. This is for two reasons. First, it is the most common category of brokers. Second, hybrid brokers invest a considerable amount of money to ensure that their business models are efficient. As mentioned, with a hybrid broker, part of the client base remains in the B-book; the others are moved to the A-book. From the standpoint of an arbitrage trader, hybrid brokers make it possible to use arbitrage, potentially for long periods of time.

The hybrid broker can further be divided into two subtypes. The first subtype is brokers that initially place all traders in the A-book and monitor their performance, moving traders who lose money to the B-book. Not every unprofitable trader might be moved to the B-book, though; all sorts of rules can be applied by the broker to deal with unique situations. For example, if a trader has a large deposit and trades with sizeable lots, the broker might not want to be exposed to the risk that comes with moving the trader to the B-book - a single profitable order with 10 lots placed by such a trader can wipe out all the profits that the broker has earned from the trader’s previous losing trades. For that reason, a trader with large orders might remain in the A-book even if that trader is losing money.

The second subtype is the opposite of the first one. It is the broker that initially places all traders - or all accounts of a certain size - in the B-book and then watches their performance. Profitable traders or “toxic traders” (i.e., traders who are flagged as arbitrage traders by the broker’s system) are moved to the A-book.

Both of these subtypes deserve our attention. More often than not, you can trade successfully with such brokers if you use the right approach.

What is the right approach? In order to work with a hybrid broker, you first need two different accounts. If you want to use the same broker, you will need to ensure that your two accounts are under different names. If you want both accounts to be under one name, then you should use two different brokers.

Also, make sure that you keep your deposits modest in both accounts; the deposit should not exceed $5,000-6000. The broker will consider a deposit of this size to be a low-risk one and will try to switch it back and forth between the A-book and the B-book as required.

Next, you add both accounts to your lock arbitrage software and set a large difference-to-open value to prevent orders from being opened. Locks are then created in the same direction for pairs that enjoy a positive correlation - for example, the EUR/USD and CHF/USD pairs. Essentially, the locks are opened in the direction of the same currency. As the market is constantly fluctuating, sooner or later, one of the accounts will have lost money, while the other account will end up with a higher deposit.

A number of things need to be taken into consideration here. Keep in mind that “triple-swap” rollover takes place every Wednesday at 17:00 ET. To avoid losing money when rollover happens, locks should be opened on Monday; if nothing happens before Wednesday, it is best to close the locks and then reopen them after some time. It is also desirable to close and reopen locks from time to time to create some semblance of trading activity.

Once one of the accounts has lost, say, half of its value and the other is up some 45% (i.e., 50% less commission fees), you can close the locks. At that point, you can withdraw the funds from the profitable account; you no longer need that account. Your focus should now be on the unprofitable account.

Open an order in the unprofitable account and look at the order execution time. If the order execution time is about 50 milliseconds, you know you are in the B-book. That’s what you want. You can now use this account in conjunction with a latency, hedge, or lock arbitrage trading strategy.

We recommend that you avoid using VPSs that are frequently used by other traders. Using a less popular VPS will allow you to trade longer with the broker. If your account is in the B-book, you can use any ordinary VPS as long as it is located in the same data center as the broker. (Naturally, do not use a VPS in New York when you are using a broker with, say, servers in London.)

Be aware that some brokers also use order execution delays in the B-book. In other words, they create an A-book environment in the B-book. You won’t be able to use that kind of broker. Experience can be helpful when you need to weed out brokers that engage in this behavior.

You will need to continuously monitor order execution times in your account. For example, if you are using a latency arbitrage strategy, note the order execution time on your first couple of orders. This time should stay constant. The moment you see an increase, you will need to close the account and withdraw your funds, as you can be sure that the broker has caught on to what you have been doing.

However, bear in mind that not all hybrid brokers are alike. Some brokers use plugins that are guided by profitability levels. That is, if the profitability of your account reaches a certain percentage of your deposit, the account is moved to the A-book. Brokers that use such plugins are ideal because they allow you to trade for long periods of time. As long as you stay below the threshold in the plugin, you can use this account. If, on the other hand, the broker uses plugins that seek to detect arbitrage strategies, you will have a hard time working with that broker.